A buy to let mortgage is a mortgage which is used to purchase a property for investment purchases. You will need to rent out to a non-family member and you will not be able to live in the property.

As they are an investment there is a greater risk so a larger deposit is required. There is a minimum deposit of 20% but generally to get the better deal it is advisable to try and get 25% together if you can.

Whether this is your first buy to let property or your 20th it is still important that you get quality advice. The market is rapidly changing and you want to make sure you are ahead of the game.

You will need landlord insurance for the property.

You may want an estate agent to manage the property for you and do routine visits to check on the property condition.

Generally speaking you will need to spend money to make sure the property is of a standard suitable to be rented. Also you may have to pay additonal property stamp suty.

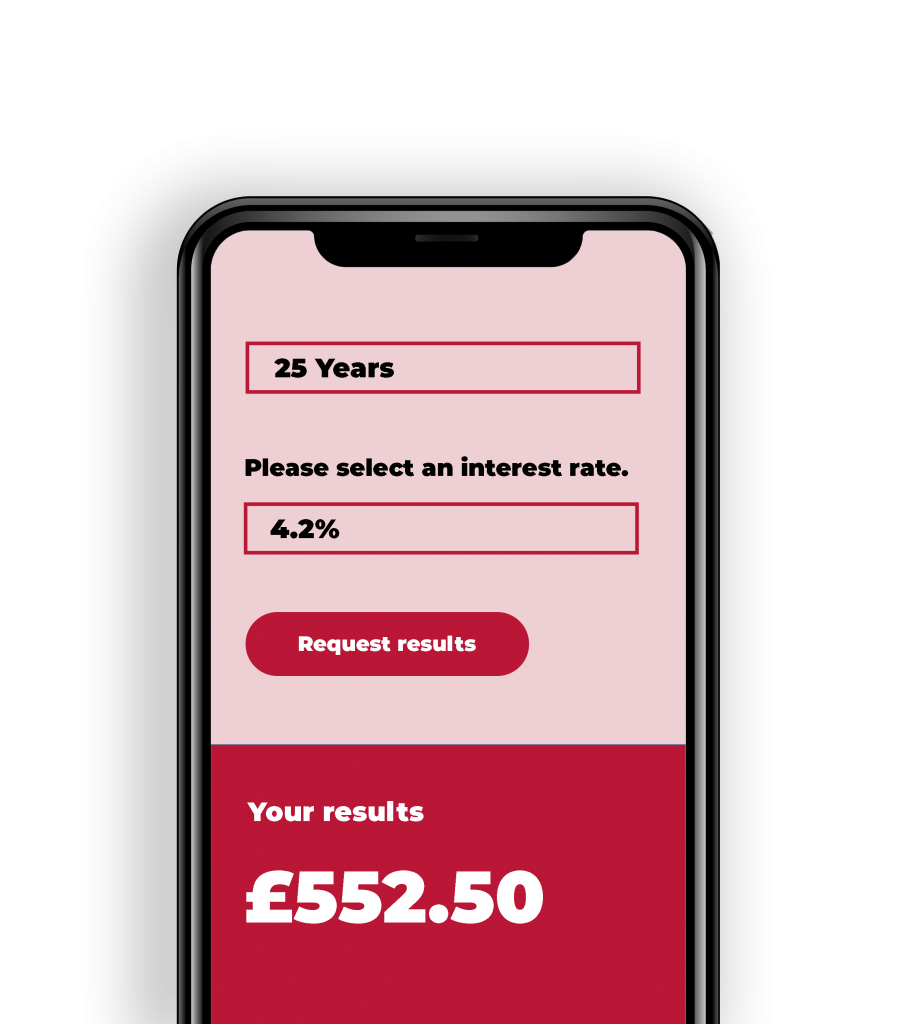

With our free to use mortgage calculator, find out what your next monthly payment could look like.

Maven Money Ltd is registered with the Data Protection Act 1998 registration No. ZB495682 and is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 987341 an Appointed Representative of TMG Direct Limited which is authorised and regulated by the Financial Conduct Authority under Firm Reference Number: 786245 and registered with the Data Protection Act 1998 Registration No: ZA178200.

Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on a mortgage or any other debt secured on it. The guidance and/or advice contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.