The most commonly asked questions, but if you have one of your own, then get in touch to ask us!

For a residential mortgage you will need at least a 5% deposit. If you are looking at a buy to let mortgage the minimum required is 20% at present.

If you go direct to a bank you are only able to access their specific products and their individual criteria. A broker has access to 1000’s of products and an extensive knowledge of criteria. This can save you so much time and money.

They also know the documents needed and the timescales each lenders are working towards. Brokers are invaluable and worth every penny.

It could be something so simple down to their criteria. It could also be the overall affordability or maybe your credit profile. This is another reason to use a broker we can make sure we are applying with the correct bank or building society for you.

When buying a house it is a condition of your mortgage that you have at least buildings insurance in place.

This will protect your home in the event of things such as fire or storm damage etc. When arranging buildings cover you can also look at contents insurance. This would basically cover all of the contents of your home if you are burgled or there is a fire or flood etc.

Make sure you are registered on the voters role this can have a big impact if you are not registered at your current address.

To do this go to https://www.gov.uk/register-to-vote

You also need to make sure all of your bills are paid on time. The easiest way to ensure this happens is to set up direct debits so you don’t forget.

The easiest way of building your credit rating is to have a credit card and use this each month and pay off the balance each month. This will prove to lenders that you can manage your money effectively.

The other insurance that is recommended is life insurance, critical Illness cover and income protection cover. Life cover would provide a lump sum if you were to die. Critical Illness would provide a lump sum upon diagnosis of a critical illness I.e cancer. Income protection would provide a replacement income in the event of an accident or long term Illness.

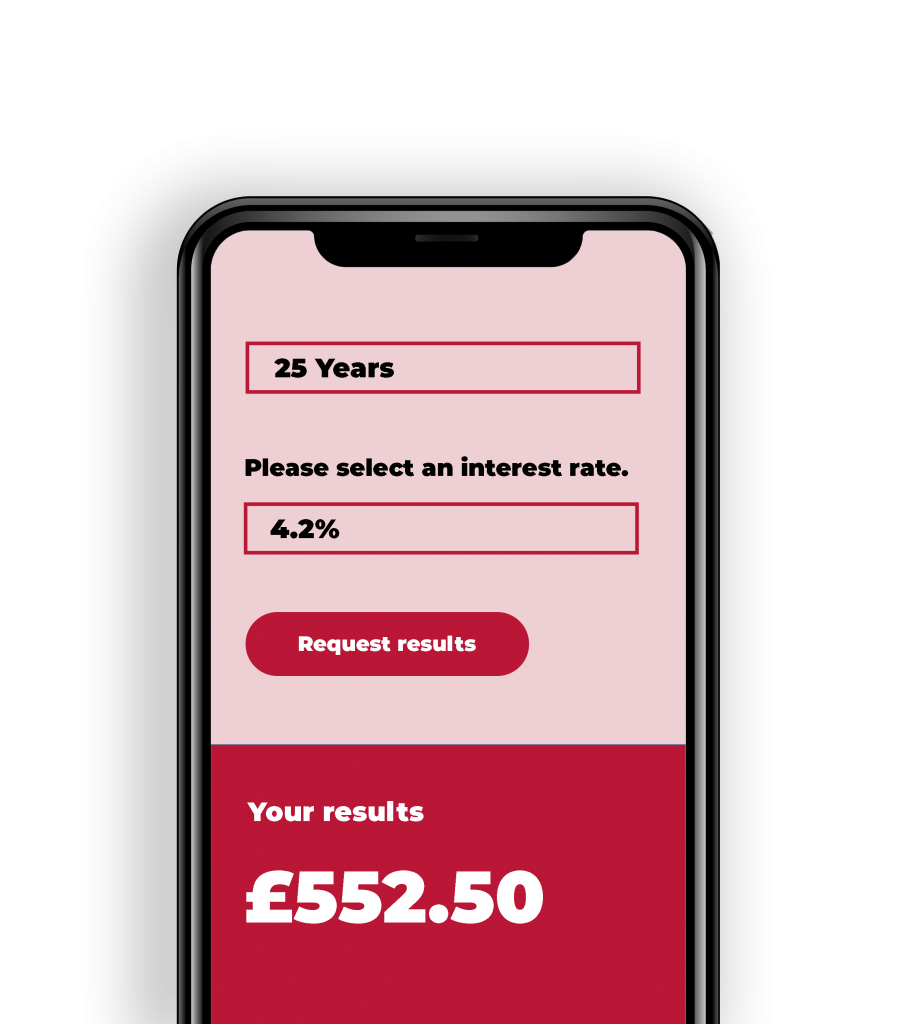

With our free to use mortgage calculator, find out what your next monthly payment could look like.

Maven Money Ltd is registered with the Data Protection Act 1998 registration No. ZB495682 and is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 987341 an Appointed Representative of TMG Direct Limited which is authorised and regulated by the Financial Conduct Authority under Firm Reference Number: 786245 and registered with the Data Protection Act 1998 Registration No: ZA178200.

Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on a mortgage or any other debt secured on it. The guidance and/or advice contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.